federal income tax amendment

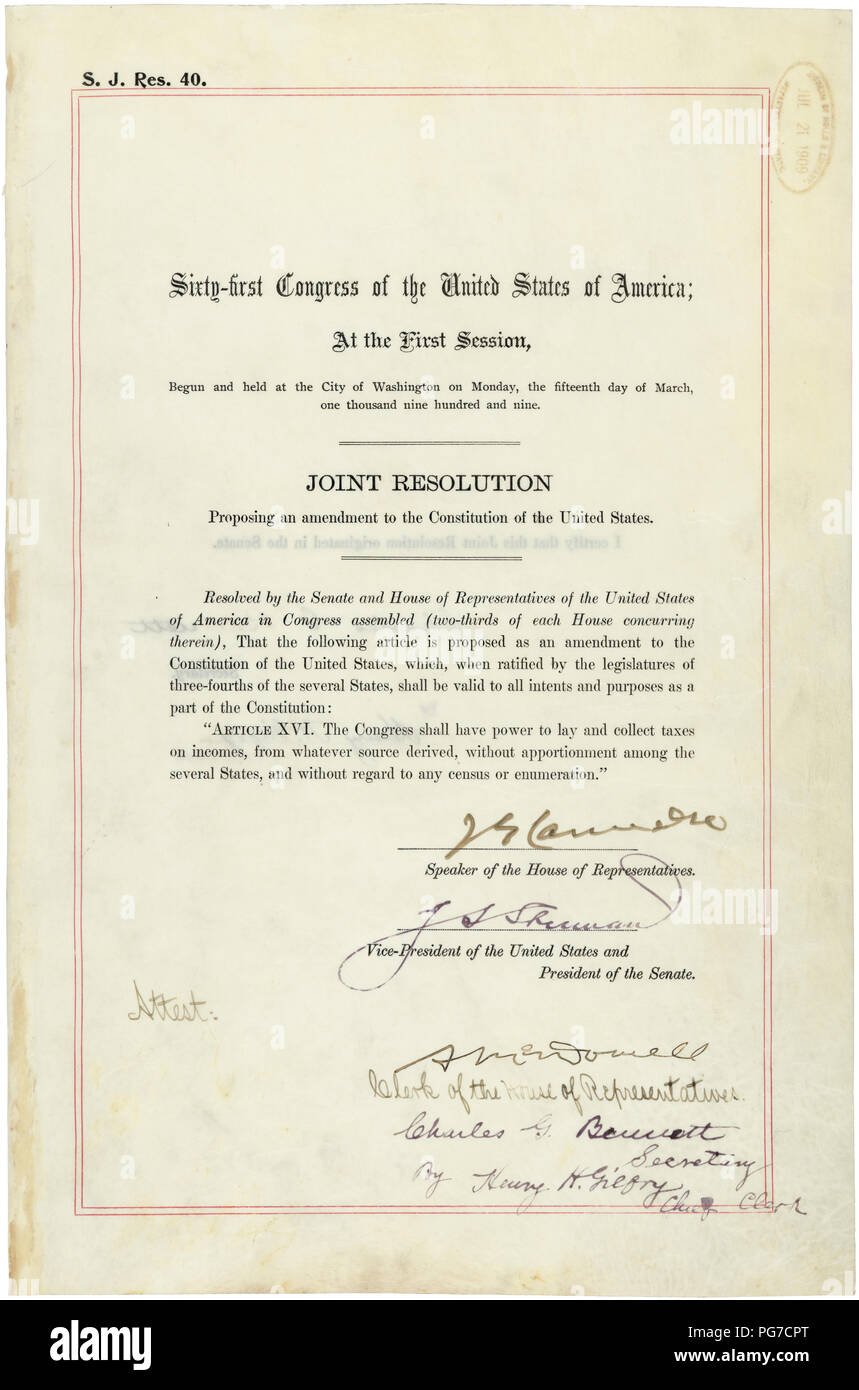

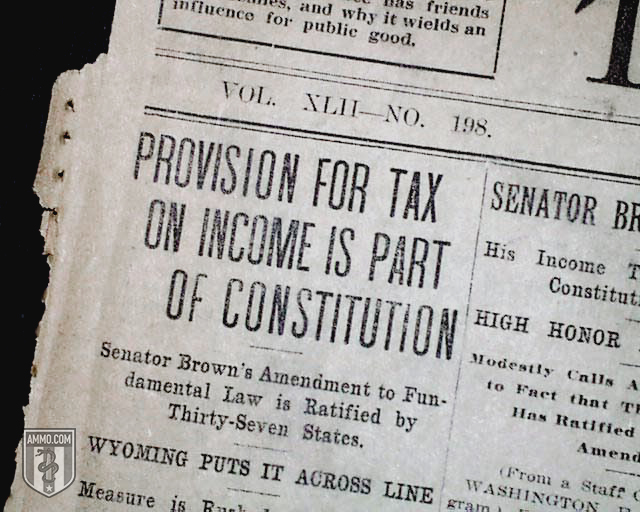

Passed by Congress July 2 1909. You can check the status of.

The Year 1913 Gave Us The Income Tax The 16th Amendment And The Irs 9gag

Understanding the 16th Amendment.

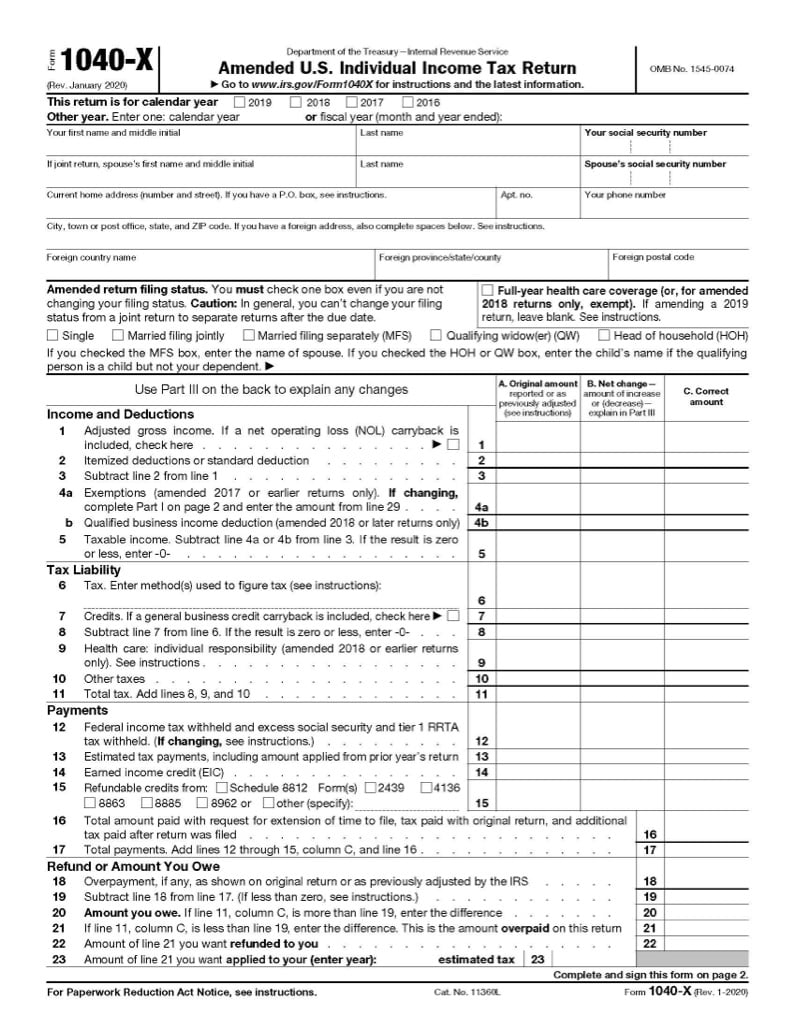

. Instructions on how to prepare an IRS tax amendment for back taxes. If you need to amend your 2019 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X Amended US. Individual Income Tax Return English Español Electronic Filing Now Available for Form 1040-X You can now file Form 1040-X electronically with tax.

If they are filing an amend 1040 or. Individual Income Tax Return to correct their tax return. July 2021Department of the TreasuryInternal Revenue Service Amended US.

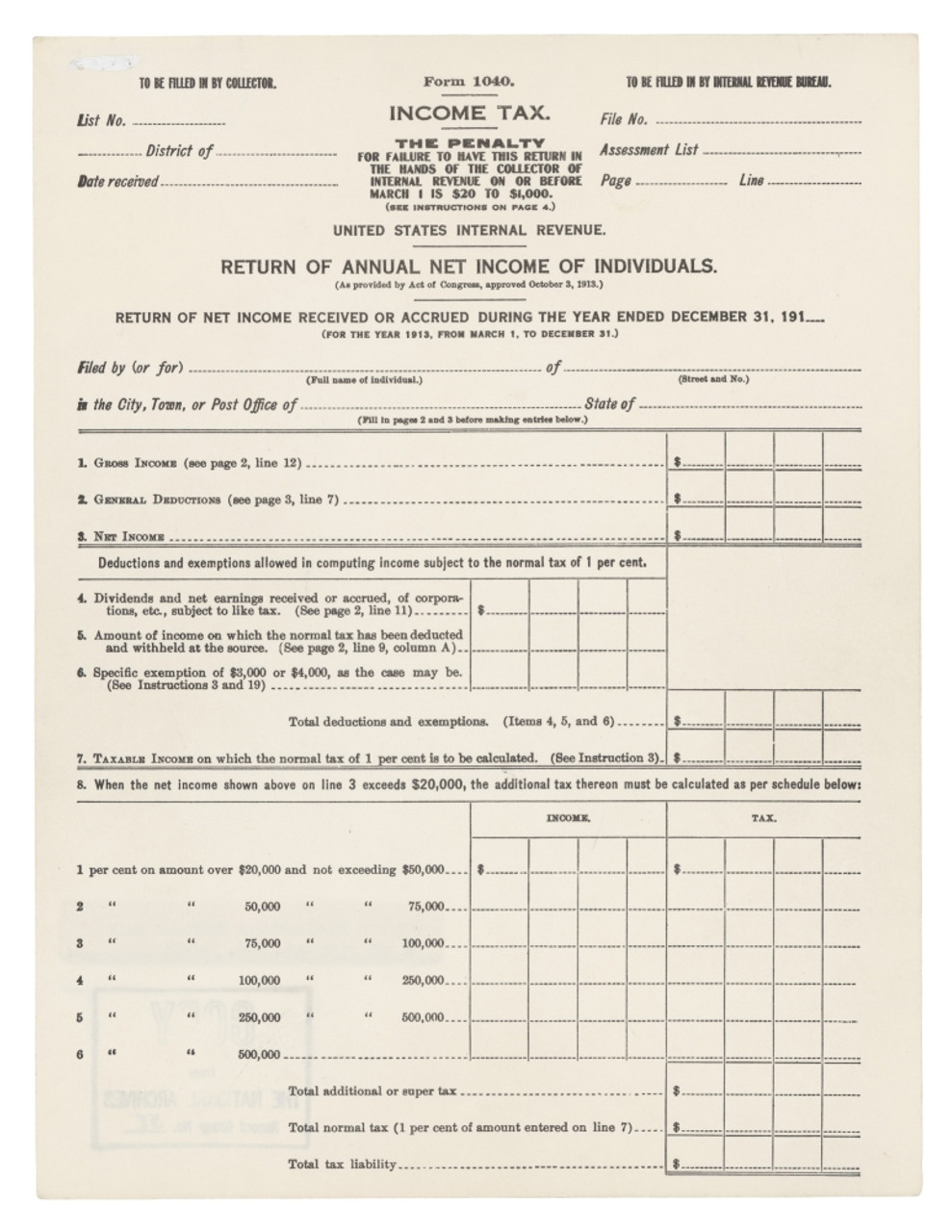

Taxpayers must file using Form 1040-X Amended US. Those with an annual income between 600 and 10000 were taxed at. Originally it only applied to less than 1 percent of the population and taxed about 1 percent of their income.

File Form 1040-X to amend. Was divided during the 1860s would be an understatement. Ripped apart at the seams by a bloody Civil War 1861.

Ratified February 3 1913. State tax amendments for the current. Prepare a tax amendment for a previous tax year.

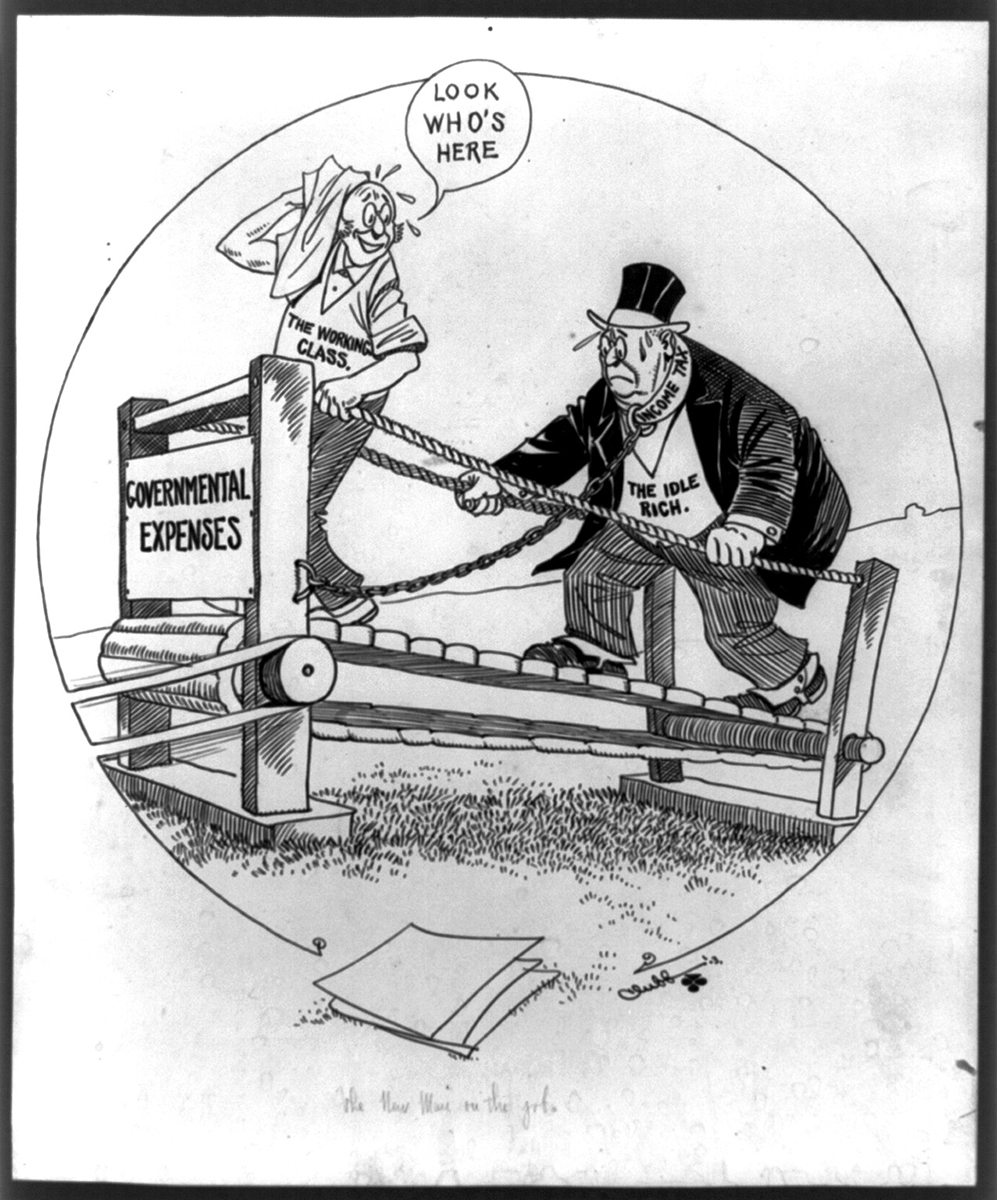

The 16th Amendment changed a portion of Article I Section 9. Since then both of those numbers have skyrocketed as the. About Form 1040-X Amended US.

Individual Income Tax Return electronically using. When the Union debt reached 500 million in 1862 Congress next passed the nations first graduated income tax. Check the status of your Form 1040-X Amended US.

You can check the status of your Form 1040-X Amended US. Generally in order for IRS to be able to issue a refund you must amend your return within three years including extensions after the date you filed your original return or within. Once you have mailed in your federal tax amendment Form 1040-X it can take up to 16 weeks or 4 months from the IRS receipt date until the form is processed.

Individual Income Tax Return Use this revision to amend 2019 or later tax returns. THE INCOME TAX AMENDMENT The single most important reason for the eventual enactment of the federal income tax was a growing conviction among people. Individual Income Tax Return for this year and up to three prior years.

To counteract the defeat the government drafted the 16 th Amendment which states The Congress shall have power to lay and collect. Online tool or by calling the toll-free. Your amended return will.

The Civil Wars Boost for a Federal Income Tax To say the US. Individual Income Tax Return using the Wheres My Amended Return. More in The Constitution.

Passed by Congress on July 2 1909 and ratified February 3 1913 the 16th amendment established Congresss right to impose a Federal income tax.

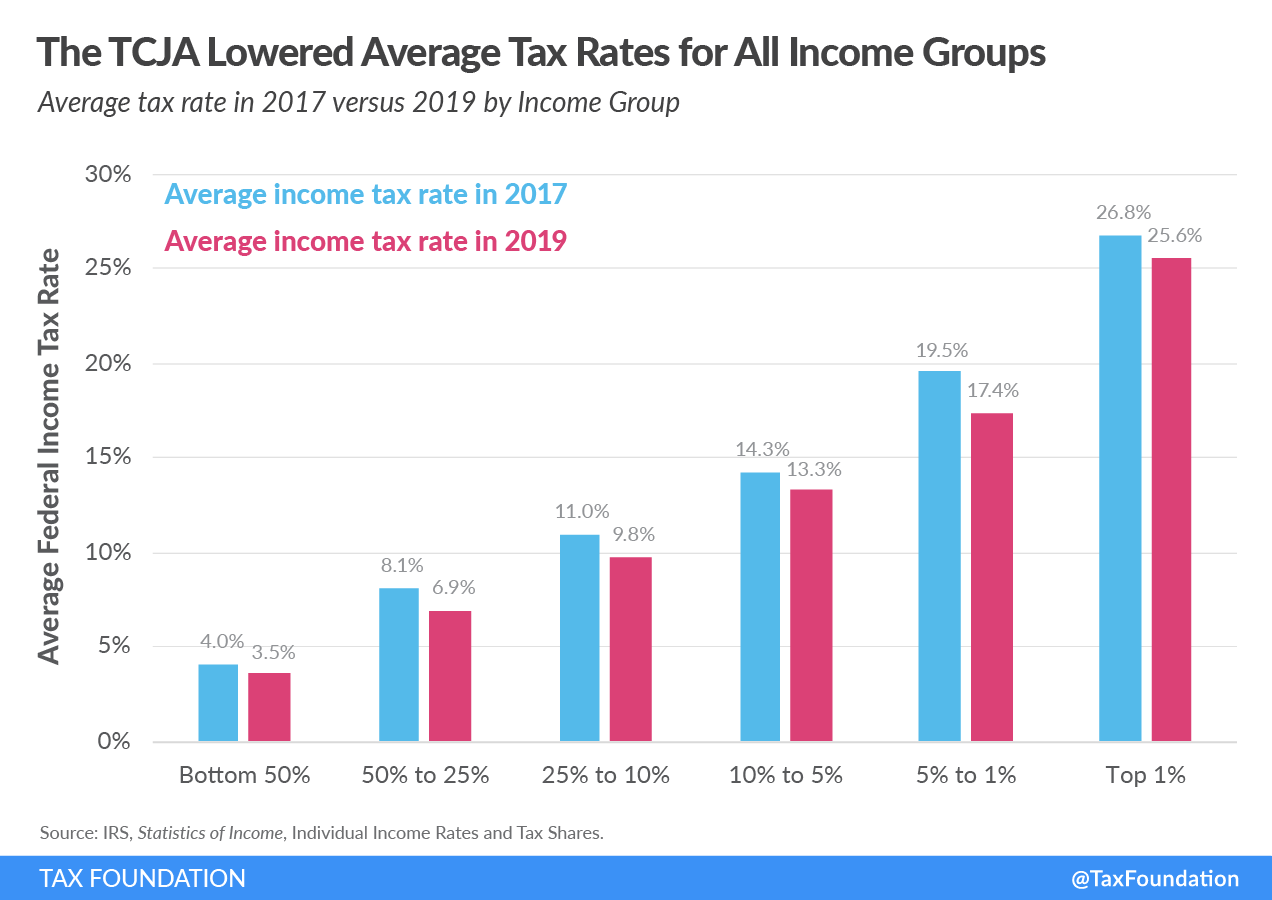

Summary Of The Latest Federal Income Tax Data 2022 Update

16th Amendment To The Constitution Establishing A Federal Income Tax 1913 Stock Photo Alamy

16th Amendment To The U S Constitution The 16th Amendment Established Congress S Right To Impose A Federal Income Tax 1913 History Item Varevchisloo1ec242 Posterazzi

Income Tax Day This Month In Business History Research Guides At Library Of Congress

The 16th Amendment A Historical Guide Of The U S Federal Income Tax

16th Amendment Storyboard By 72059e32

History Of Taxation In The United States Wikipedia

1913 Federal Income Tax 1040 Form The Sixteenth Amendment Establishing The Income Tax Was Ratified On

Understanding Taxes Theme 6 Understanding The Irs Lesson 1 The Irs Yesterday And Today

Filing An Amended Tax Return Form 1040x Jackson Hewitt

The 16th Amendment A Historical Guide Of The U S Federal Income Tax

Of Beer And Taxes Prohibition S Connection To The National Income Tax Heinz History Center

Films Media Group Amendment 16 Federal Income Tax

Of Beer And Taxes Prohibition S Connection To The National Income Tax Blog

Sixteenth Amendment Periodic Presidents

Blame The 16th Amendment For Federal Income Taxes Observer

Taxes Us Government Facts For Kids Cool Kid Facts